A simplified approach to wealth management & your family office

We redefined an outdated model to better suit you and your wealth management needs.

Our proven process provides a systematic approach, focusing on the areas of your life that have the biggest impact.

Knight Foundation

ALIGNMENT

We align ourselves with you

Our approach is tailored to fit you, your current financial position and future goals.

SIMPLICITY

SIMPLIFIED WEALTH MANAGEMENT

Our objective is to simplify how your wealth is managed and maintained.

TRANSPARENCY

TRANSPARENCY CREATES ACCOUNTABILITY

Systems and processes designed for complete accountability and transparency.

TECHNOLOGY

BEST IN CLASS TECHNOLOGY

Leveraging technology to provide clarity, transparency and accountability.

PEOPLE

TEAM BUILT FOR YOU

We only work with people like you

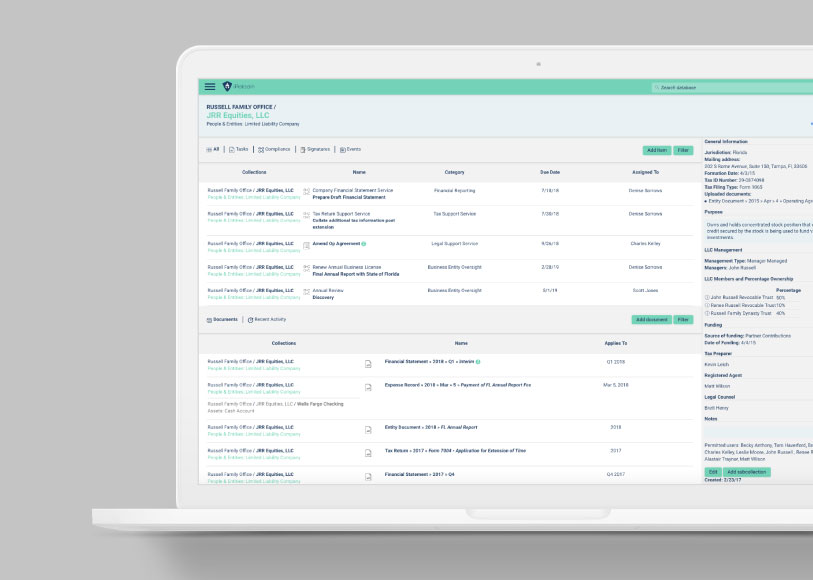

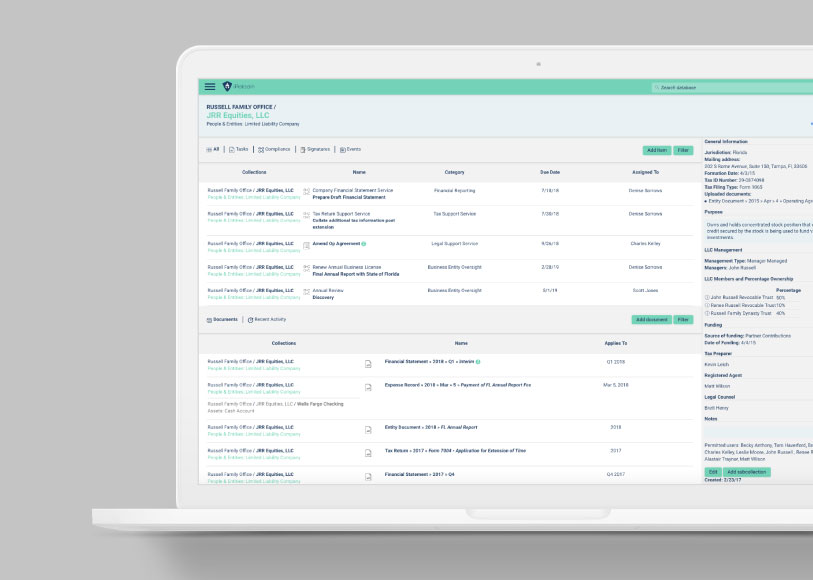

THE VIRTUAL WAY TO MANAGE YOUR FAMILY OFFICE.

What We Offer

Our platform applies a simpler, more convenient way to scale the increasing demands of a family office and provide the necessary transparency and accountability, to monitor performance across various metrics. A valuable resource in a family office ecosystem, such as ours, is the ability to focus our attention effectively. We have the unique ability to connect your whole team allowing us to deliver valuable services in a more strategic focus with the goal being to effectively grow and transfer wealth across generations.

Why This Matters To You

We believe that in order to properly help our clients achieve their goals as effectively and efficiently as possible, organization is key. We use the Knight Digital Family Office, to continually perform an informal audit review of each of the clients entities, assets and liabilities as well as any administrative services needed to fill identified gaps such as missing documentation, areas of untapped opportunity and potential areas of liability based on the clients goals. No stone is left unturned.

What We Offer

Our Consolidated Third Party Reporting platform allows us to track and analyze any type of asset and liability. Our best in class technology grants us access to instantly verify, analyze, and visualize any type of portfolio, including tightly held business interests, private placements and alternatives with complex ownership. We have the ability to drill down to what matters most at any moment in time empowering us to make more informed and timely investment decisions. This also gives us the ability to continually model out and take advantage of estate planning and tax strategies.

Why This Matters To You

In order to proactively plan, it is imperative that families have complete transparency through instant verifiable data around all of their assets and liabilities. This alleviates the bottle neck when trying to make decisions around investments and taxes.

What We Offer

Our approach to asset management is individualized and different than most asset managers. The traditional asset managers typically have a single focus on liquid assets and often fail to meet the complex needs and desires of our wealth creator clients. Our clients often own tightly held businesses, directly owned real estate and various other private placements that need to be taken into consideration to determine an overall investment strategy and risk management solution. We have found that the majority of investment plans do not have the continuity or transparency that is needed to create efficient portfolios that will meet the clients objectives. The foundation of our investment philosophy is a solid proactive risk management solution within our liquid asset strategy that can complement and allow the more complex holdings to produce maximum returns while maintaining the proper liquidity needed to capitalize on future opportunities in the private markets while addressing liquidity and cash flow needs.

The same 10M dollars can look and feel completely different and have a dramatically different net effect to the clients lifestyle and goals due to TAXES, VOLATILITY, RISK and LIQUIDITY.

Why This Matters To You

Our approach is based on accountability to our investment process and the transparency needed for our clients to understand how their assets are being managed. We break our approach down to three key components:

LIQUIDITY & CASH FLOW

This component is the most crucial to a comprehensive investment strategy. Each family — depending on their cash flow, current liabilities, risk tolerance and where they are in their business or personal lifecycle — will have different liquidity timeframes, cash flow needs and goals. Our team of Accounting, Legal and Financial professionals partner with our clients to continually determine the right approach for each family.

RISK MANAGEMENT & LIFESTYLE ENHANCEMENT

We view these two risks as the core long-term issues that any portfolio must address. Having an investment portfolio that addresses the long-term effects of inflation is more important than ever in the current “low interest rate” environment. We simply can’t just invest in bonds for the long-term and expect to maintain or increase our lifestyle. We are being forced to take more “risk” to meet our goals. This is why a proactive risk management plan is crucial to being able to keep our clients “in the game” to achieve the maximum risk versus reward performance.

LEGACY

Once we solve for the most important pillars in our clients lives, we then focus on providing value for future generations and/or charitable aspirations. The type of assets owned and the proper ownership of these assets is key to minimizing taxes and providing a legacy that can survive multiple generations.

What We Offer

Our approach to asset management is individualized and different than most asset managers. The traditional asset managers typically have a single focus on liquid assets and often fail to meet the complex needs and desires of our wealth creator clients. Our clients often own tightly held businesses, directly owned real estate and various other private placements that need to be taken into consideration to determine an overall investment strategy and risk management solution. We have found that the majority of investment plans do not have the continuity or transparency that is needed to create efficient portfolios that will meet the clients objectives. The foundation of our investment philosophy is a solid proactive risk management solution within our liquid asset strategy that can complement and allow the more complex holdings to produce maximum returns while maintaining the proper liquidity needed to capitalize on future opportunities in the private markets while addressing liquidity and cash flow needs.

The same 10M dollars can look and feel completely different and have a dramatically different net effect to the clients lifestyle and goals due to TAXES, VOLATILITY, RISK and LIQUIDITY.

Why This Matters To You

Our approach is based on accountability to our investment process and the transparency needed for our clients to understand how their assets are being managed. We break our approach down to three key components:

LIQUIDITY & CASH FLOW

This component is the most crucial to a comprehensive investment strategy. Each family — depending on their cash flow, current liabilities, risk tolerance and where they are in their business or personal lifecycle — will have different liquidity timeframes, cash flow needs and goals. Our team of Accounting, Legal and Financial professionals partner with our clients to continually determine the right approach for each family.

RISK MANAGEMENT & LIFESTYLE ENHANCEMENT

We view these two risks as the core long-term issues that any portfolio must address. Having an investment portfolio that addresses the long-term effects of inflation is more important than ever in the current “low interest rate” environment. We simply can’t just invest in bonds for the long-term and expect to maintain or increase our lifestyle. We are being forced to take more “risk” to meet our goals. This is why a proactive risk management plan is crucial to being able to keep our clients “in the game” to achieve the maximum risk versus reward performance.

LEGACY

Once we solve for the most important pillars in our clients lives, we then focus on providing value for future generations and/or charitable aspirations. The type of assets owned and the proper ownership of these assets is key to minimizing taxes and providing a legacy that can survive multiple generations.

THE VIRTUAL WAY TO MANAGE YOUR FAMILY OFFICE.

KNIGHT DIGITAL FAMILY OFFICE

WHAT WE OFFER

Our platform applies a simpler, more convenient way to scale the increasing demands of a family office and provide the necessary transparency, to monitor performance across various metrics. A valuable resource in a family office ecosystem, such as ours, is the ability to focus our attention effectively. We have the unique ability to connect your whole team allowing us to deliver valuable services in a more strategic focus with the goal being to effectively grow and transfer wealth across generations.

WHY THIS MATTERS TO YOU

We believe that in order to properly help our clients achieve their goals as effectively and efficiently as possible, organization is key. We use the Knight Digital Family Office, to continually perform an informal audit review of each of the clients entities, assets and liabilities as well as any administrative services needed to fill identified gaps such as missing documentation, areas of untapped opportunity and potential areas of liability based on the clients goals. No stone is left unturned.

INDEPENDENT CONSOLIDATED THIRD PARTY REPORTING

WHAT WE OFFER

Our Consolidated Third Party Reporting platform allows us to track and analyze any type of asset and liability. Our best in class technology grants us access to instantly verify, analyze, and visualize any type of portfolio, including tightly held business interests, private placements and alternatives with complex ownership. We have the ability to drill down to what matters most at any moment in time empowering us to make more informed and timely investment decisions. This also gives us the ability to continually model out and take advantage of estate planning and tax strategies.

WHY THIS MATTERS TO YOU

In order to proactively plan, it is imperative that families have complete transparency through instant verifiable data around all of their assets and liabilities. This alleviates the bottle neck when trying to make decisions around investments and taxes.

ASSET MANAGEMENT

WHAT WE OFFER

Our approach to asset management is individualized and different than most asset managers. The traditional asset managers typically have a single focus on liquid assets and often fail to meet the complex needs and desires of our wealth creator clients. Our clients often own tightly held businesses, directly owned real estate and various other private placements that need to be taken into consideration to determine an overall investment strategy and risk management solution. We have found that the majority of investment plans do not have the continuity or transparency that is needed to create efficient portfolios that will meet the clients objectives. The foundation of our investment philosophy is a solid proactive risk management solution within our liquid asset strategy that can complement and allow the more complex holdings to produce maximum returns while maintaining the proper liquidity needed to capitalize on future opportunities in the private markets while addressing liquidity and cash flow needs.

The same 10M dollars can look and feel completely different and have a dramatically different net effect to the clients lifestyle and goals due to TAXES, VOLATILITY, RISK and LIQUIDITY.

WHY THIS MATTERS TO YOU

Our approach is based on accountability to our investment process and the transparency needed for our clients to understand how their assets are being managed. We break our approach down to three key components:

LIQUIDITY & CASH FLOW

This component is the most crucial to a comprehensive investment strategy. Each family — depending on their cash flow, current liabilities, risk tolerance and where they are in their business or personal lifecycle — will have different liquidity timeframes, cash flow needs and goals. Our team of Accounting, Legal and Financial professionals partner with our clients to continually determine the right approach for each family.

RISK MANAGEMENT & LIFESTYLE ENHANCEMENT

We view these two risks as the core long-term issues that any portfolio must address. Having an investment portfolio that addresses the long-term effects of inflation is more important than ever in the current “low interest rate” environment. We simply can’t just invest in bonds for the long-term and expect to maintain or increase our lifestyle. We are being forced to take more “risk” to meet our goals. This is why a proactive risk management plan is crucial to being able to keep our clients “in the game” to achieve the maximum risk versus reward performance.

LEGACY

Once we solve for the most important pillars in our clients lives, we then focus on providing value for future generations and/or charitable aspirations. The type of assets owned and the proper ownership of these assets is key to minimizing taxes and providing a legacy that can survive multiple generations.