When you partner with Knight Family Wealth, you partner with a team designed specifically for you.

We know that as wealth increases, life often becomes more complex, and it isn’t as simple as going from “A” to “B.” At Knight Family Wealth, we understand each family’s personal roadmap is different, and we’ll get you from “A” to “Z” with all the stops in between, assuring that every family’s individual objectives are met. Our strategic business, accounting and legal expertise and extended knowledge network connects you to some of the brightest minds and a team that is tailored to your specific needs.

At Knight Family Wealth, everything we do is guided by our core values: being accountable for the value we add to your life and the transparency in our methods, which provides a compounding effect on your family’s wealth and well-being for generations to come.

ABOUT

The mission of Knight Family Wealth is to provide ultra high-net-worth families simplicity through accountability and transparency, to create the greatest compound effect well beyond money.

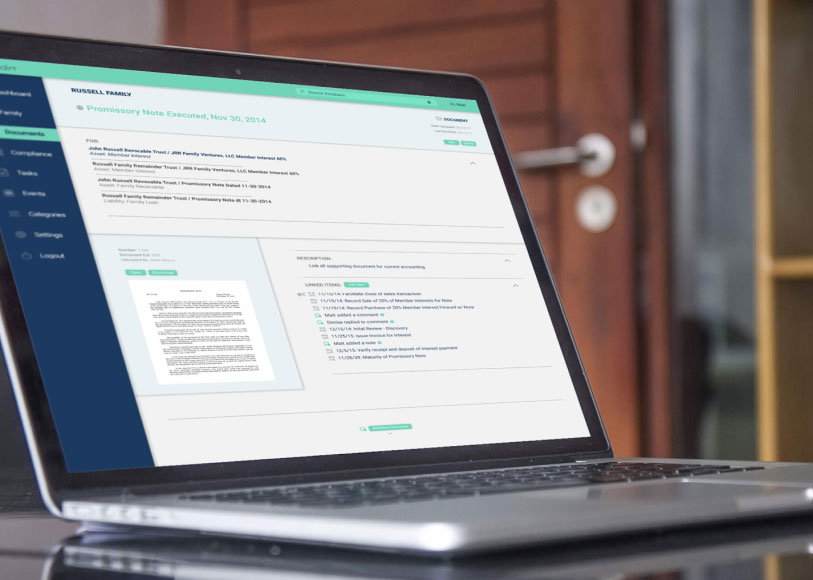

We believe that consistently making the right decisions over time creates the largest compound effect in the client’s life. We identified that the current systems and institutions were heavily focused on AUM and liquid assets, which didn’t serve all the needs of our ultra high-net-worth clients. Private Placements, closely held businesses, directly owned real estate and the effect that taxes have on our client’s overall success were often being overlooked. Our clients needed a platform and an experienced team that would make their complex lives simpler and more transparent to enable them to make informed decisions.

We assist by creating rules, systems and processes around every asset and liability on their balance sheet. Our clients have these systems built in their businesses and our job as their “Family CFO” is to build those same systems and decision-making processes around their wealth.

Proven Process

The financial services industry is built on an outdated model of primarily liquid investment management. Knight Family Wealth has redesigned the model, building a completely new infrastructure and process from the ground up.

We leverage technology to enable you to achieve more, keep more and do more with your wealth. Our firm focuses on attention to detail, avoiding costly decisions such as unnecessary taxes and missed or overlooked planning opportunities, to create the largest compound effect. Our mission is to provide you with transparency and accountability, showing you the areas that will have the biggest impact on your wealth and well-being.

Our Process

01

Align

This is a 15-minute introductory meeting to define your goals and objectives and determine if we are the right team for you and you are the right fit for us. Our alignment is critical from Day 1.

02

Discover

Our Team will take a deep dive into your current position and identify areas of untapped opportunity and potential areas of liability

03

Strategize

In collaboration with you, we will create your scope of work and action plan.

04

Deploy

We will create your Digital Family Office, customized independent third-party consolidated reporting portal and execute your scope of work

05

Optimize

We continually strategize and enhance your position based on current economic and tax environments to stay in line with your family’s key objectives, goals and vision

Fee Structure

Knight Family Wealth believes in full transparency and accountability in our approach.

What we bring to the table is essential to achieve your goals. Because of our industry experience, we’ve redefined the process and built a team specifically for you to ensure that you only receive the highest quality service and advice. We recognize that we have to earn your business (and your investment in us), so we deliver actionable advice where value far outweighs your investment. In order to create accountability to execute and oversee the most important aspects of your wealth that often have the greatest impact, we create a clearly defined executive summary and scope of work each year to manage both partners’ responsibilities.

Aligned with our mission of transparency, our relationships start with a flat annual Family Office and Wealth Advisory fee instead of just a percentage of investable assets. This helps us create accountability and transparency in every area of our relationship.

Liquid Asset Management Fee

We don’t keep our fees hidden. Our liquid asset management fee for clients with less than $5M in investable assets that we actively manage is 1.0% . We don’t charge any further hidden fees. It really is that simple.